A. Importance of health insurance for senior citizens in India

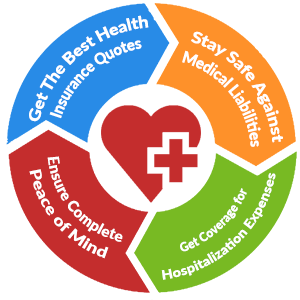

- Discuss the significance of having health insurance coverage for senior citizens in India, highlighting the increasing healthcare costs and specific health needs of this age group.

B. Purpose of the guide

- Emphasize that the purpose of the guide is to provide detailed information and guidance on the best health insurance plans available in India for senior citizens, enabling them to make informed choices.

Understanding the Health Insurance Needs of Senior Citizens

A. Common health concerns for seniors in India

- Discuss the prevalent health conditions and ailments that senior citizens in India commonly face, such as diabetes, hypertension, arthritis, etc.

B. Coverage requirements specific to senior citizens

- Explain the unique healthcare needs of senior citizens, including hospitalization, medical consultations, diagnostic tests, medication, etc., and how health insurance plans should address these requirements.

C. Financial considerations and budgeting

- Discuss the financial challenges faced by senior citizens and the importance of considering factors like premiums, deductibles, co-payments, and out-of-pocket expenses when choosing the best health insurance plans.

Types of Health Insurance Plans Available for Senior Citizens

A. Individual health insurance plans

- Explain individual health insurance plans that cater specifically to senior citizens, highlighting their benefits, coverage options, and suitability for individuals.

B. Family floater plans

- Describe family floater plans that cover senior citizens along with other family members, emphasizing their advantages, cost-effectiveness, and considerations for choosing the right plan.

C. Senior citizen-specific plans

- Discuss health insurance plans specifically designed for senior citizens, focusing on their tailored benefits, coverage limits, and unique features catering to their healthcare needs.

D. Government-sponsored health insurance schemes

- Provide an overview of government-sponsored health insurance schemes available for senior citizens in India, such as Ayushman Bharat, and highlight the eligibility criteria, coverage, and benefits of these schemes.

Key Factors to Consider When Choosing a Health Insurance Plan

A. Coverage and benefits

- Explain the importance of evaluating the coverage and benefits offered by health insurance plans, including inpatient care, outpatient care, pre- and post-hospitalization expenses, ambulance services, etc., and how to assess their adequacy for senior citizens.

B. Network of hospitals and healthcare providers

- Discuss the significance of having a wide network of hospitals and healthcare providers tied up with the insurance plan, enabling easy access to quality healthcare services for senior citizens.

C. Pre-existing condition coverage

- Highlight the importance of pre-existing condition coverage and explain how it works, including waiting periods, exclusions, and the necessity to disclose existing ailments during policy application.

D. Waiting periods and exclusions

- Explain the concept of waiting periods and exclusions in health insurance plans, particularly as they apply to senior citizens, and discuss how to navigate these factors when choosing the best plan.

E. Premiums and affordability

- Provide insights on premium calculations, factors affecting premium amounts for senior citizens, and tips on finding affordable yet comprehensive health insurance plans.

F. Claim settlement process and customer support

- Discuss the significance of a smooth and efficient claim settlement process and reliable customer support, ensuring hassle-free interactions during medical emergencies and claim settlements for senior citizens.

Researching and Comparing Health Insurance Providers

A. Reputable insurance companies in India

- Highlight well-known and reputable health insurance companies in India that offer suitable plans for senior citizens, focusing on their track record, customer satisfaction, and credibility.

B. Online resources and tools for comparing plans

- Provide information on online resources, comparison websites, and tools available to compare

different health insurance plans for senior citizens, assisting in making informed decisions.

C. Seeking recommendations and reviews

- Suggest seeking recommendations from trusted sources, including friends, family, and healthcare professionals, and considering online reviews and testimonials to gain insights into the experiences of others with various health insurance providers.

Step-by-Step Guide to Selecting the Right Health Insurance Plan

A. Assessing personal healthcare needs

- Guide readers on evaluating their specific healthcare needs, considering factors such as existing health conditions, preferred hospitals, healthcare preferences, etc.

B. Estimating coverage requirements

- Help senior citizens estimate the required coverage amount based on their medical history, anticipated expenses, and healthcare expectations.

C. Evaluating plan features and benefits

- Provide a checklist of essential features and benefits to consider, such as room rent limits, sub-limits, no-claim bonus, restoration benefits, etc., while evaluating health insurance plans.

D. Obtaining quotes and premium calculations

- Explain the process of obtaining quotes from different insurance providers and understanding the premium calculations, considering age, coverage, and other factors.

E. Reading and understanding policy documents

- Guide readers on thoroughly reading and comprehending policy documents, terms, and conditions, ensuring clarity and avoiding misunderstandings.

F. Seeking expert advice if needed

- Suggest seeking guidance from insurance experts, agents, or financial advisors when navigating complex health insurance options, especially for senior citizens.

Tata AIG Health Insurance:

Tata AIG Health Insurance is a renowned name in the insurance industry, offering comprehensive health insurance plans for families. Their policies provide extensive coverage for hospitalization expenses, pre and post-hospitalization costs, daycare procedures, and critical illnesses. With cashless hospitalization facilities and a wide network of hospitals, Tata AIG ensures that your family receives the best medical care without financial stress.

HDFC ERGO Health Insurance:

HDFC ERGO Health Insurance is a trusted provider offering a range of family health insurance plans. Their policies cover hospitalization expenses, including room charges, doctor fees, and medical tests. Additionally, they offer benefits like coverage for pre-existing conditions, maternity expenses, and cashless hospitalization. With a strong claim settlement track record and a wide network of hospitals, HDFC ERGO is an excellent choice for family health insurance.

ICICI Lombard Health Insurance:

ICICI Lombard Health Insurance is known for its comprehensive health insurance plans tailored to meet the needs of families. Their policies cover hospitalization expenses, pre and post-hospitalization costs, and daycare treatments. They also offer add-on benefits like maternity coverage, coverage for alternative treatments, and a cashless facility. With a high claim settlement ratio and a vast network of hospitals, ICICI Lombard provides reliable health insurance options for families.

Bajaj Allianz Health Insurance:

Bajaj Allianz Health Insurance offers family health insurance plans that provide comprehensive coverage and additional benefits. Their policies cover hospitalization expenses, pre and post-hospitalization costs, critical illnesses, and maternity expenses. With cashless hospitalization facilities and a wide range of network hospitals, Bajaj Allianz ensures hassle-free medical services for your family.

National Health Insurance:

National Health Insurance is a reputable health insurance provider offering affordable plans for families. Their policies cover hospitalization expenses, pre and post-hospitalization costs, and ambulance charges. They also provide cashless hospitalization facilities and have tie-ups with a vast network of hospitals across India. With their customer-centric approach and commitment to prompt claim settlement, National Health Insurance is an excellent choice for families seeking affordable coverage.

Tips for Maximizing Health Insurance Benefits

A. Wellness programs and preventive care

- Highlight the importance of wellness programs, preventive care services, and health check-ups provided by health insurance plans, emphasizing their role in maintaining overall well-being for senior citizens.

B. Utilizing cashless hospitalization services

- Explain the concept of cashless hospitalization and guide senior citizens on utilizing this service effectively, including understanding the processes, documents required, and reimbursement claims.

C. Renewal and portability options

- Discuss the significance of timely renewal and the availability of portability options for health insurance plans, providing tips on managing policy renewals for senior citizens.

D. Making timely premium payments

- Emphasize the importance of making timely premium payments to ensure uninterrupted health insurance coverage, avoiding policy lapses and related complications.

Additional Resources and Support for Senior Citizens

A. Government initiatives and schemes

- Provide information on additional government initiatives and schemes available for senior citizens in India, apart from health insurance, which can support their healthcare needs.

B. NGOs and community support programs

- Highlight the role of non-governmental organizations (NGOs) and community support programs that offer assistance, counseling, and resources for senior citizens regarding health insurance and healthcare.

C. Senior citizen forums and online communities

- Encourage senior citizens to participate in online forums and communities dedicated to senior citizen healthcare, where they can gather information, seek advice, and share experiences with other individuals in similar situations.

Conclusion

A. Recap of key points

- Summarize the main takeaways from the guide, emphasizing the importance of making informed choices regarding health insurance plans for senior citizens in India.

B. Encouragement to take proactive steps

- Encourage senior citizens and their families to take proactive steps in evaluating, comparing, and selecting the best health insurance plans available, highlighting the peace of mind and financial security it can provide in times of medical emergencies.

Comments

Post a Comment